Beijing, China, April 02, 2018 –(PR.com)– A detailed white paper, with research on the implementation of a new financial system called revenue royalties, has been published, simultaneously in English and in Chinese. The study document was authored by Michael North, Partner in Asia-Pacific Group; by Liu Meiyan, Vice General Manager, Business Innovation Department at CITIC Trust Co.; and by Arthur Lipper, originator of the Lipper Index and a well-known financial advisor in the international business community for more than 60 years.

The white paper is available to view and download at no charge, in English:

http://www.asiapacificgroup.us/royalties-seminar-17/the-vision-of-revenue-royalties/

And in Chinese:

http://www.asiapacificgroup.us/zh-hans/royalties-seminar-17/vision-revenue-royalties/

“This paper is the product of years of applied research, and it presents the case for revenue royalties in one consolidated, clear package,” said Michael North. “With the assistance of my long-time partner Arthur Lipper, we show how the two main types of securities that dominate the financial world today — equity and debt — can be diversified with the addition of a third option: paying a share of topline revenues to investors. With the assistance of Liu Meiyan at CITIC Trust, we also consider specific issues relevant to China and its public debt challenges.”

Arthur Lipper added, “This White Paper lays out the general case for revenue royalties for businesses worldwide, and then considers their suitability to potential financing for long-term, large-scale public infrastructure projects. There is a specific focus on the advantages for public-private partnerships (PPP) in China, which could be significant for similar public sector financing in the United States and other countries.”

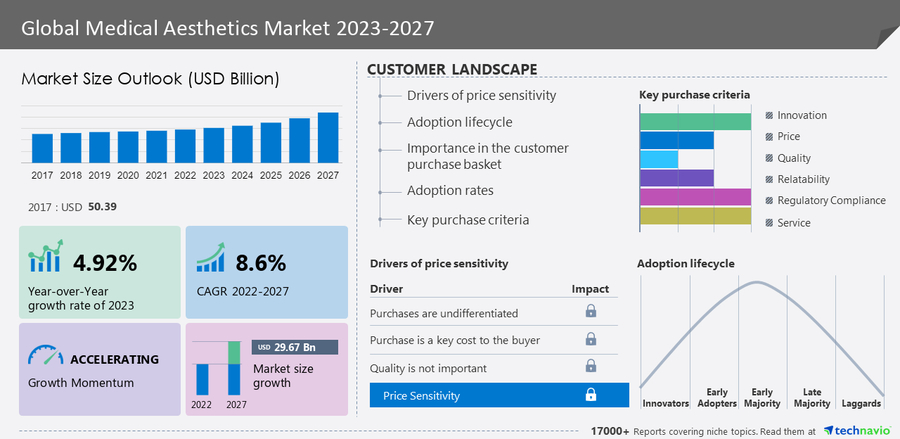

Here are brief excerpts, including a sample graphic:

"In its most basic framework, a revenue royalties transaction has the following five basic components:

1. Purchase by investors of an agreed percentage of a defined revenues of an enterprise (known as a revenue royalty);

2. For an agreed period of time;

3. With investor protections and a right of early redemption for the enterprise;

4. With quarterly distribution to investors of the agreed royalty payments, possibly with an agreed minimum;

5. Allowing investors to receive a targeted rate of return on investment.

"Standard royalties compensate owners for the use of assets which already exist – and pay for their valuable use, after they are created. A best-selling author may receive an advance for a book, but he or she is responsible for doing all the work needed to write the book, and for its expenses.

"Revenue royalties work the other way around, in a sense. The investment is provided in advance to a company in order the produce anticipated result, which is increasing gross revenues over a period of time, for all of its products and services.

"Virtually every type of security is either equity or debt, or some combination of the two. This White Paper proposes adding a third option – revenue royalties – to the equity/debit polarity.

"Instead of the duopoly of equity and debt, and their combination, investors and their advisors may also structure investments that are pure revenue royalties, or combinations of equity and royalties, debt and royalties, or all three. From a total of three options today, we can increase the choices to seven, and perhaps the resulting financial system will have more dynamics, more flexibility, and more stability.

"Royalties have been used for at least 2500 years, though they were not known as royalties until 1670. One of the oldest companies in the world has roots in royalties – in fact, it was responsible for the coinage of the word 'royalties' itself, meaning 'belonging to the King.'

"We’re referring to the Hudson’s Bay Company, listed on the Toronto Stock Exchange. In 1670, North America was beginning to be explored, and England claimed a huge area for King Charles II. The company is still in business today, and still paying returns to investors after almost 350 years.

"Public-private partnerships (PPP), now being widely adopted in China, harness the resources of government in land and natural resources to the capital investment and efficient management of the private sector. But PPP is still running on an engine of debt, and China is over-leveraged.

"How to raise capital without continuing to increase debt? Royalties may offer an answer in China. If used with PPP’s, royalties may reduce dependence on debt by the public sector. They could make more and larger projects feasible, with a positive contribution to the national priority to improve the quality of the environment and public health, secure greater energy independence, and contribute to the lofty goal of building an 'ecological civilization'."

The system proposed in the White Paper has now been officially introduced in China. Study and fund development groups are evaluating it for implementation; see:

http://www.asiapacificgroup.us/royalties-seminar-17/ (English), or

http://www.asiapacificgroup.us/zh-hans/royalties-seminar-17/ (Chinese)

You may download this press release here:

http://www.asiapacificgroup.us/wp-content/uploads/2018/03/White-Paper-Press-Release-033018.pdf

The full White Paper document, in both English and Chinese, may be downloaded here:

http://www.asiapacificgroup.us/wp-content/uploads/2018/03/Royalties-Whitepaper-en-cn.pdf

Contact Information:

Asia-Pacific Group

Michael North

808-638-7100

Contact via Email

http://www.asiapacificgroup.us

China phone: 1366-125-8223

WeChat ID: peacemanager

Read the full story here: https://www.pr.com/press-release/749147

Press Release Distributed by PR.com